4.9 on Capterra

Get More Leads_

Financial Calculators For Websites

Turn website visitors into qualified leads with embeddable finance calculators. Automate the capture of client details and follow up to increase conversions.

No credit card required

Cancel anytime

Financial Calculators for Every Need_

Build your online presence with dynamic financial tools

Feature packed calculators

Build any type of calculator for your website. Personalize it with our finance calculator software. The potential is almost limitless.

Powerful conditional logic

Create complex question branching with our powerful conditional logic. You can build even the most complicated financial calculator.

No coding skills needed

Easily build a calculator with our drag-and-drop feature. Or choose from our library of premium templates - no coding needed.

Powerful integration

Integrate your calculator with your favorite CRM or marketing tool through Zapier. And integrate with 1000+ apps.

Highly customizable

It’s easy to customize a calculator to match your website and branding. Seamlessly make your calculator a part of your website.

Any platform, anywhere

Embed a financial calculator on your website or standalone landing page in minutes. We integrate with every platform or CMS. And our software is 100% supported on mobile.

Flexible, versatile & powerful_

Loved by 1,000+ businesses around the world

We were spending 3-7 days to price and quote a project. With our lead funnel, it's completely automated.

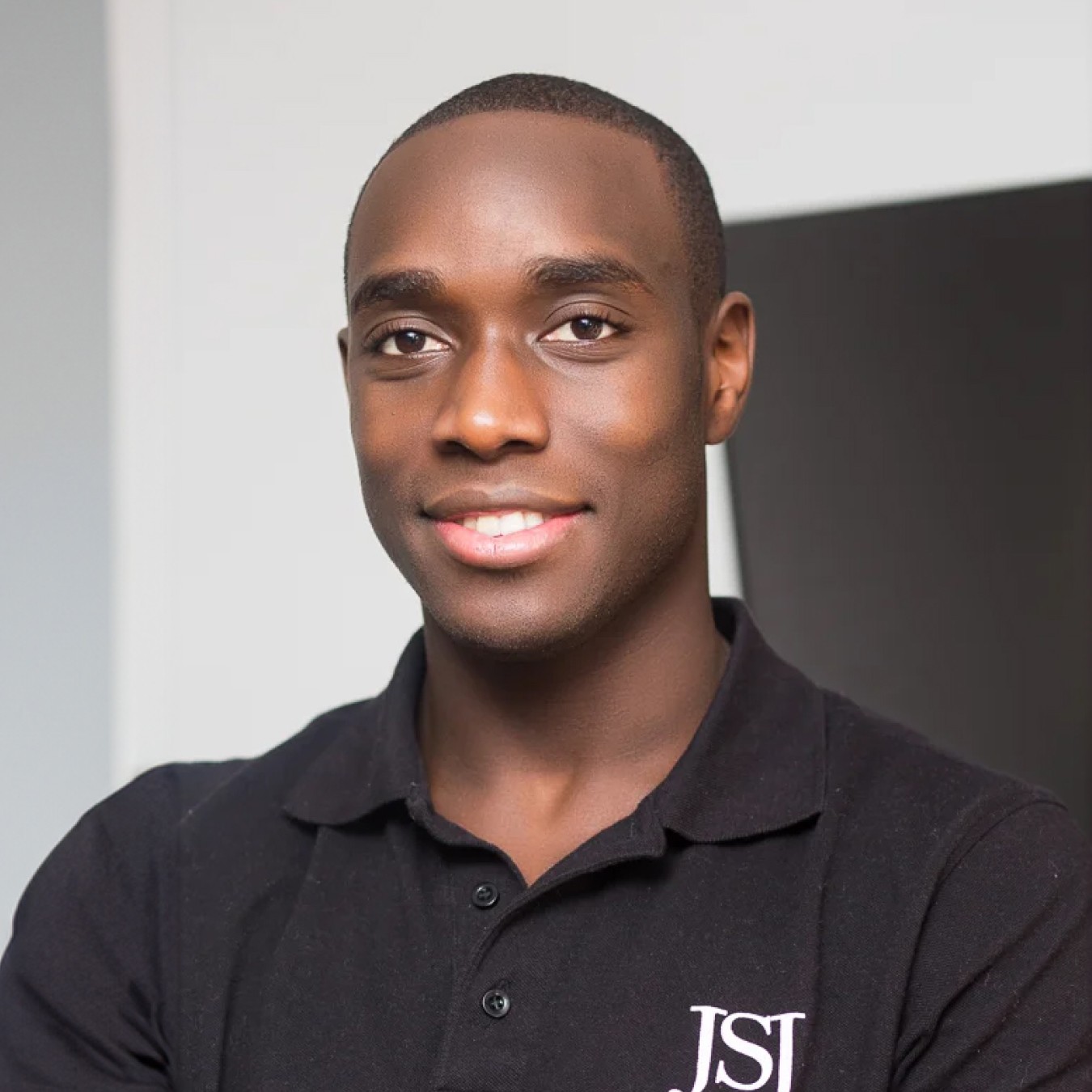

“ Stephan knight

Stephan knightDirector, JSJ Smart Homes

Customers self-quote quickly and efficiently — It saves time and improves customer satisfaction.

“ Frank Sandqvist

Frank SandqvistFounder, Smidyo

Demand-based pricing & real-time availability booking is the holy grail. Convert_ is crazy powerful.

“ Justin Goodhart

Justin GoodhartFounder, Goodhart Coffee

Convert_ is flexible, cost efficient, feature-rich, and integrates perfectly with HubSpot.

“ Ashley Johnston

Ashley JohnstonMarketer & advertiser

It's straight-forward: my team will be able to adjust it themselves and make iterations super easy.

“ Michiel Esveld

Michiel EsveldProject Lead, Rabo Innovations

Customers tailor pricing to their budget on my website. When they submit, they're ready to book.

“ Matt Reilly

Matt ReillyFounder, Rift Photography

We now capture leads through tailored questions and provide real-time ROI calculations.

“ Warre Vandoorne

Warre VandoorneMarketing manager, Eltex

Convert_ is a versatile builder with smart and responsive support that quickly got us started!

“ Shelly Goodman

Shelly GoodmanMarketing & advertising

Building our configurator was very effective. It's looking professional and fits with our brand.

“ Jorrit Heidbuchel

Jorrit HeidbuchelCo-founder, Ellio

We're no more missing leads, and we've got a lot of increase in conversion.

“ Pira

PiraGrowth marketeer

FAQ_

FAQ: Finance calculator commonly asked questions

Visit our docs if you want to learn more, or reach out to our support team. We’re very responsive.

What types of finance calculators can I create?

You can potentially create any type of calculator with our powerful software. The following are a few examples:

What are the benefits of having a financial calculator on my website?

Having a finance calculator on your website serves your business in several ways.

1. Lead generation - a financial calculator is an effective lead generation tool. Visitors using one on your website are likely interested in your services. You can capture their contact information on the calculator and follow up with them.

2. Data insights - gain valuable insights into customer behavior with a financial calculator. This information allows you to adjust your marketing strategy or offer your customers targeted financial solutions.

3. Better user experience - an interactive calculator gives people a better user experience. They can input their information and get personalized solutions directly on your website, saving them time and effort. A better customer experience leads to higher customer satisfaction.

4. Value-added service - letting your customers make financial calculations on your website shows your commitment to giving them value. It removes a barrier to their financial literacy and demonstrates your willingness to help. That goes a long way to boosting your brand image.

5. Competitive advantage - using financial calculator software gives you an edge over competitors that don’t use it. An interactive calculator sets you apart from other businesses in your industry. More customers will seek you out for these helpful resources.

6. Educational resource - help people understand financial implications with a calculator. It helps them gain a better understanding of their financial situation.

7. Customer empowerment - assist customers with making informed financial decisions. They can calculate loan payments, savings projections, investment returns, etc. You give people a helpful resource and establish trust.

8. Industry authority - providing customers with resources and answers to questions positions you as an industry authority. So a calculator shows your credibility to people seeking financial solutions.

Website Content for Better Marketing

Boost your marketing efforts with a financial calculator. It creates an interactive experience where clients can engage with your products and get answers to their financial questions.

Marketing

Attract people to your website.

Calculators are like a magnet for website users. They’re generally the most popular pages on a website.

You can promote your services on a calculator. Add links to the solutions to customer problems.

Capture leads with a financial calculator to follow up later.

Interaction

Engage clients with your content.

Let customers enter information for personalized results.

Show data in novel ways - dynamic charts, graphs, tables, etc.

Simplify complex financial calculations with user-friendly questions.

Education

Answer their finance questions.

Mortgages: How much can I borrow?

Retirement: How much savings do I need?

Investment: How much can I expect to gain?

What is financial calculator software?

Financial calculator software provides the functionality of a finance calculator on a digital platform. It helps you build a calculator for your website, so your customers can calculate mortgage repayments, plan retirement savings, etc.

Our software provides a user-friendly interface. You can easily create a calculator with our drag-and-drop feature - no coding skills needed.

We also have premium templates to choose from. These have a range of built-in formulas and functions that simplify complex calculations. And they’re highly customizable to meet your needs.

Can I increase conversions with a financial calculator?

Yes, you can increase conversions with a financial calculator. They help you educate customers and guide them through the buying journey. You can use them at the top of the sales funnel to increase customer awareness and build trust.

A financial calculator also captures warm leads. Customers give you their contact information and answer personalized questions. That allows you to gauge their problems and follow up with tailored solutions.

The combination of building customers’ trust and solving their problems can increase conversions.

Is financial calculator software compatible with different currencies and exchange rates?

Some finance calculator software has currency conversion capabilities. They can allow users to calculate with different currencies based on current exchange rates.

ConvertCalculator has powerful calculation capabilities. You can use our software to perform calculations with different currencies and exchange rates. The calculation potential is almost limitless.

How do I add a fincance calculator to my website?

Adding your calculator is simple:

Copy and paste the code snippet we give you into your website

Use our direct integrations with WordPress, Webflow, Wix, and Shopify

Embed as a popup, inline element, or full-page experience

Share via direct link for email campaigns or social media

The entire process takes just minutes, no developer needed.