What is a Business Loan Calculator?

Business loans are often the quickest way for business owners to get additional capital for essential business operations. And unlike other types of funding, it doesn’t require them to give up a stake in the business in exchange.

As the name implies, business and commercial loans are only granted to qualified businesses and are meant to be used purely for business purposes.

Business owners take out business loans for lots of different reasons. But the most common ones are:

- Funding growth and expansion plans

- Purchasing new equipment/additional inventory

- Hiring more employees

- Dealing with immediate cash flow problems

A Business Loan Calculator helps business owners easily figure out the ideal loan terms and repayment plans that will best suit their current and future financial situation. Loan repayments will negatively affect a business’s cash flow so it’s important to carefully scrutinize all the details of a loan to make sure you can actually afford it and that it puts you in a good position for long-term success.

Business Loan Calculators can provide additional details about a loan such as:

- A breakdown of principal and interest payments

- Actual APR (Annual Percentage Rate)

- Total loan fees

- Total interest cost

- Total cost of the loan

A Business Loan Payment Calculator can quickly estimate how different loan terms and interest rates can affect how much your monthly payments will be. This allows you to easily compare loans from different providers so you can pick out the best deals possible.

Banks, financial institutions, and lending companies might also feature a Business Loan Calculator on their website that gives business owners an estimate of how much they can borrow based on some basic financial information such as:

- Historical annual revenue

- Monthly bank statements/deposits

- Credit score

- How long the business has been operating

- Business and personal assets

How are Business Loan Payments Calculated?

Calculating how much a monthly loan payment really only requires some high school math. But you’ll definitely need to use a calculator and you’ll have to go through multiple steps before you arrive at the final number.

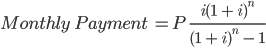

Here’s what the monthly payment or amortization formula looks like: